Financial crime or financial crime is gaining momentum, especially in the business sectors. It encompasses several crimes, including money laundering, tax fraud, corruption, financing of terrorism and drug trafficking, among others. What is financial crime? What are the repercussions on a country's economy? What about sanctions? How to combat this scourge? Lighting with Me Robin Pothiah

What is financial crime or financial crime?

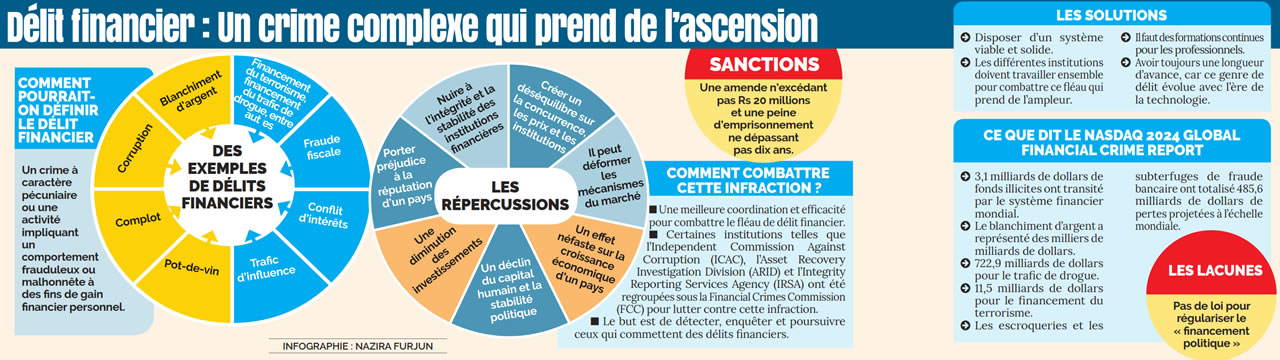

The term “financial crime” is not specifically defined in our law. That said, the said term is often used as an umbrella term for a monetary crime or activity involving fraudulent or dishonest behavior for the purpose of personal financial gain. However, this offense should not be taken lightly, as it can have serious consequences at the economic and social level of a country.

How widespread is this offense?

Financial crime is unfortunately not something new in the criminal sphere. In the Nasdaq 2024 Global Financial Crime Report, an estimated $3.1 billion in illicit funds passed through the global financial system. Money laundering accounted for trillions of dollars, $722.9 billion for drug trafficking and $11.5 billion for terrorist financing. Scams and bank fraud schemes totaled $485.6 billion in projected losses globally. It is for this reason that the Financial Crimes Commission (FCC) was introduced through the Financial Crimes Commission Act 2023 (FCCA) to detect, investigate and prosecute those who commit financial crimes.

What are the penalties for financial crime?

Under the new law introduced by the Financial Crimes Commission Act (FCCA), anyone convicted of a financial offense is liable to a fine not exceeding Rs 20 million and imprisonment not exceeding ten years.

Examples of financial crimes?

As noted above, financial crime is an umbrella term that encompasses a range of crimes. These are: money laundering, corruption, conspiracy, bribery, conflict of interest, influence peddling, tax fraud, terrorist financing and drug trafficking financing, among others.

How does it affect the economy of a country?

Obviously, financial crime has a detrimental impact on any economy of a country. Maurice is unfortunately not spared. Take for example, the crime of money laundering which falls under the umbrella of financial crime. It can harm the integrity and stability of financial institutions. Illicit sums entering the financial system can distort market mechanisms, creating an imbalance by affecting, among other things, competition, prices and institutions.

If this practice goes unpunished, it can damage a country's reputation. The continuation of this practice of impunity can in turn erode the necessary legal and regulatory frameworks. As for corruption, it will lead to a reduction in investment, a decline in human capital and political stability. These problems, in turn, also affect the economic growth of the country concerned.

How to fight this crime?

For better coordination and efficiency in combating the scourge of financial crime, certain institutions such as the Independent Commission Against Corruption (ICAC), the Asset Recovery Investigation Division (ARID) and the Integrity Reporting Services Agency (IRSA) have been assimilated under the Financial Crimes Commission (FCC). These institutions aim to detect, investigate and prosecute those who commit financial crimes.

Do we have the tools to combat this offense?

Mauritius was for some time on the gray list of the Financial Action Task Force (FATF). Fortunately, the country was removed from this list by adopting the FATF recommendations, which allowed it, in turn, to leave the European Union blacklist.

With the Financial Crimes Commission Act (FCCA), several laws were repealed such as the Prevention of Corruption Act (PoCA), part of the Financial Intelligence and Anti-Money Laundering Act (FIAMLA), the Assets Recovery Act (ARC) , the Good Governance and Integrity Reporting Act (GGIRA). These laws were later reinstated. The objective is also to strengthen the Financial Crimes Commission Act (FCCA) to combat this scourge and be more effective.

What are the gaps in our legislation?

Despite the good intention of repealing certain laws and then integrating them and strengthening the Financial Crime Commission Act (FCCA), legislators have still not addressed or simply ignored the issue of “political financing”. There is no transparency when it comes to donations, nor where the money linked to political financing comes from.